Cheap Insurance in Arizona

Since our beginning in 1992, we have dedicated ourselves to offering affordable insurance coverage that protects you from life’s unexpected events. At L.A. Insurance, our clients are at the center of everything we do. Being an independent insurance agency, we proudly serve the entire state of Arizona by providing a variety of coverage options customized to your needs.

As one of the best insurance companies in Arizona, L.A. Insurance offers a wide selection of coverage choices that make sure you find the insurance policy that works best for you. We are fully capable of providing insurance coverage whether you need cheap car insurance in Arizona, affordable renters' insurance, commercial auto insurance, or motor vehicle insurance. Our dedicated and friendly insurance agents can provide personalized services that will certainly help you to make informed decisions regarding your insurance needs.

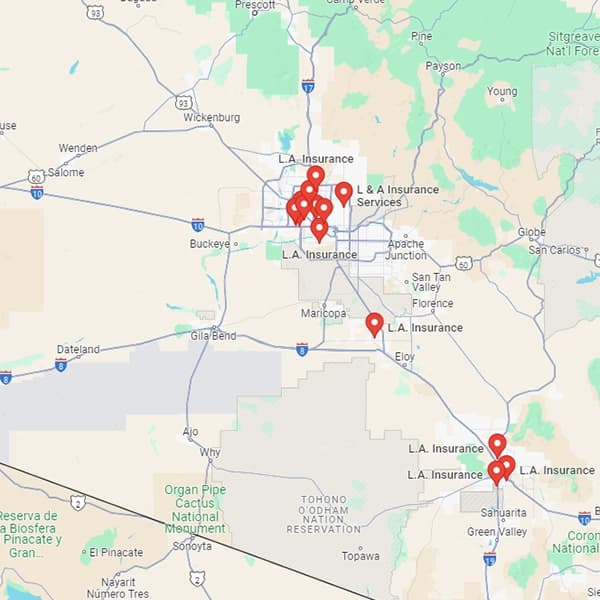

We’ve years of experience in the insurance industry in Arizona. This makes it easier for us to commit to the citizens of Arizona that we will deliver the most affordable and quality insurance products. We have done this before and we’re continuously doing it. This helped us grow into one of the largest independent insurance agency franchises in North America. We have over 200 locations across Arizona and other states. So, you can visit us whenever you need!

L.A. Insurance Offers a Wide Range of Insurance Products in Arizona

We’re proud to offer comprehensive insurance products and value-driven insurance solutions to all our reputed clients in Arizona. Whether you need customized insurance policies or personalized services, we are always here to help you out.

Here is a list of insurance services we offer for Arizona residents:

Affordable Auto Insurance in Arizona: Protects you against financial loss if you are hit by another car or involved in a collision with other objects. We also offer protection to your vehicle against all kinds of theft and damage. At L.A. Insurance, you’ll receive liability coverage, collision coverage, and comprehensive insurance coverage options for your car.

Arizona Motorcycle Insurance: Riders in Arizona now can get cheaper motorcycle insurance coverage from us. We provide safety to your favorite motorbike against accident, theft, and damage. Our affordable motorcycle insurance coverage options include liability, collision, and comprehensive policies.

Low-Cost RV and Motorhome Insurance: We have specialized coverage for recreational vehicles and motorhomes. So, you’ll get protection for your motorhome against various risks during travel and camping.

Cheap Renters Insurance Arizona: We provide the best renter’s insurance for Arizonans which covers personal property within a residence at a competitive rate. Our policyholders for renter’s insurance will receive protection against all kinds of stolen property. Plus, they will receive liability for accidents occurring in the rental property.

Affordable Boat and Watercraft Insurance: L.A. Insurance offers coverage for boats and watercraft so that your vacations and adventures in the beautiful lakes of Arizona are protected. Get a free insurance quote online and protect your boat and personal watercraft against accidents, theft, and damage.

Cheap Commercial Auto Insurance in Arizona: We make sure every car business owner in Arizona gets cheap commercial auto insurance. This is why L.A. Insurance offers protection against financial loss from accidents, and liability coverage for vehicles. If you have businesses with company cars or delivery vehicles, this insurance policy can save you from unfortunate incidents.

Life Insurance: At L.A. Insurance, we offer budget-friendly life insurance options to help support your family’s financial future. Our plans include both term and whole life policies, designed to cover everything from daily living costs to mortgage payments in the event of your passing. Whether you're just starting a family or planning long-term, our flexible coverage ensures your loved ones aren’t left with unexpected burdens.

Key Factors Influencing Insurance Rates in Arizona

Looking to get the cheapest insurance in Arizona? We can help you find one. To find the most affordable insurance coverage, you need to be aware of the key factors that are influencing insurance rates in Arizona. The most common factors that may impact the insurance price in Arizona are driving records, location, age and gender, type of vehicle, and so on.

Here is a list of some factors that may influence the insurance price in Arizona:

- Driving Record: Your driving history may play a vital role in deciding your insurance rate. If you have a clean driving record, you’ll most likely get lower premiums. If not, your insurance rate might get higher.

- Age and Gender: Teenagers usually face higher premiums due to their lack of driving experience. Statistical data also shows the same variation in insurance rates based on gender where young males typically pay higher premiums than young females.

- Location: If you live somewhere in Phoenix or Tucson where accidents occur frequently, you might have to pay greater insurance premiums compared to rural areas.

- Type of Vehicle: Your insurance rate is also affected by the make, model, and year of your vehicle. In case you’re the owner of an expensive car, sports car, or newer model, it will cost you more to insure because of higher repair costs and theft rates.

- Coverage Levels: Whether it’s liability, collision, or full coverage insurance, the level of your coverage directly affects your premium. Note that though higher coverage levels ensure better protection but come at a higher price.

- Credit Score: Credit score is another key factor that may influence insurance rates in Arizona. Since insurers often use credit score or credit history as a factor in determining rates, higher credit scores may result in lower premiums. Because a higher credit score means you have a good record of maintaining financial responsibility.

- Claims History: Your past insurance claims are also a key factor that decides your total insurance premium. If you have already claimed insurance too often, it can result in higher premiums. Because this indicates a greater probability of potential claims.

Strategies for Finding Low-Cost Insurance in Arizona

If you want lower premium rates to get the cheapest Arizona insurance quote online, you can follow some simple strategies.

Here are some tips for finding affordable insurance policies in Arizona state:

- You can combine auto, home, and other insurance policies and qualify for insurance discounts.

- By maintaining a clean driving record (e.g., avoid accidents, and traffic violations) to get lower premiums.

- You can compare quotes with other insurers as well to find the best insurance rate.

- Getting a car with good safety ratings can lower premiums as this indicates lower repair costs.

- Pay your premiums in full annually to receive a lower premium rate.

Why Is L.A. Insurance the Right Option for Cheap Insurance Policy in Arizona?

L.A. Insurance stands out as a top choice for affordable insurance in Arizona. We are committed to delivering customized options that meet each client's distinctive needs.

Here are key reasons why you should consider L.A. Insurance:

- Fast Estimates Directly from Agents

- Fast Binding Time

- Affordable Down Payment

- Comprehensive Coverage Options

- Comparable Significant Savings

- Personalized Service

- Direct Agent Access

- 24/7 Customer Support

LA Insurance All Locations In Arizona

Explore all our convenient LA Insurance locations across Arizona. With multiple offices statewide, we’re always nearby to provide you with affordable and comprehensive insurance solutions tailored to your needs.

Insurance Services We Offer in Arizona

Find the wide range of insurance services we offer in Arizona. From auto and motorcycle to renters and commercial auto insurance, LA Insurance has all your coverage needs covered.