Cheap Insurance in Michigan

Searching for the most affordable insurance in Michigan? L.A. Insurance based in Detroit, MI, proudly welcomes you to explore different insurance coverage options. We’re not only one of the best insurance companies in MI but also the most trusted partner in delivering quality insurance coverage at competitive prices.

Since our establishment in 1992 in Detroit, we have faithfully served the insurance needs of diverse clients of Michiganders with excellence and commitment. As one of North America's leading independent insurance agency franchises, operating over 200 locations across various states including Michigan, we gladly offer comprehensive and wallet-friendly insurance policies.

Whether you reside in Detroit, Grand Rapids, Ann Arbor, or anywhere else in Michigan, L.A. Insurance is always willing to help you find the most suitable and cheap insurance policies for you based on your needs, budget, and preferences. You might need cheap car insurance, commercial auto insurance, motorcycle insurance, or renter’s insurance. Our insurance agency provides comprehensive protection for all your insurance needs.

Types of Insurance We Offer in Michigan

L.A. Insurance offers comprehensive insurance coverage at a very low price. Our cheap insurance policies cover everything from accidents and theft to damage and liability. This means our value-driven insurance solution ensures you and your assets are fully protected.

Here's a list of insurance we offer to Michiganders:

Auto Insurance: We offer affordable auto insurance in Michigan with comprehensive insurance coverage options. Our policies include collision coverage, vehicle damages, bodily injury liability, and accident coverage to make sure you’re safe in any situation.

Motorcycle Insurance: Riders can protect themselves and their bike too if they get insured with L.A. Insurance. We deliver the cheapest full coverage motorcycle insurance to all riders of Michigan. Our affordable motorcycle insurance policies include collision coverage, bodily injury liability, parts and accessories replacement, and medical payments. Get a free motorcycle insurance quote online with our low-cost, reliable insurance options.

RV and Motorhome Insurance: With L.A. Insurance, you can insure your home on wheels in Michigan. We provide the most affordable RV and motorhome insurance coverage for Michigan residents. Our policies include collision and comprehensive protection, liability for bodily injury, and property damage.

Renter’s Insurance: Renter’s insurance refers to property insurance, protects your personal properties, and provides liability coverage while you rent a home or apartment. We have created cheap renter’s insurance policies that cover personal property loss, liability for bodily injury or property damage, and additional living expenses.

Boat and Watercraft Insurance: Our boat and watercraft insurance offer full protection for your marine voyages. It covers liability, collision, theft, vandalism, windstorm, or lightning, and medical payments for injured passengers. Whether you’re sailing on the lakes of Michigan or cruising its rivers, you can do it more peacefully than before by becoming a policyholder of our cheap boat and watercraft insurance.

Commercial Auto Insurance: If you want to protect your business vehicles and drivers, you can easily insure with affordable commercial auto insurance with us. We provide various coverage for your vehicles including accidents, liability claims, and property damage. Do you run a fleet of delivery trucks or company cars? No worry! Our commercial car insurance policies guarantee your financial security.

Life insurance: L.A. Insurance helps you financially protect your family and dependents in the event of an unexpected loss. We offer affordable term life and whole life insurance options tailored to fit your lifestyle and long-term goals. Whether you're looking to cover funeral costs, pay off debts, or support your loved ones’ future expenses, our life insurance policies provide dependable coverage. Get a free life insurance quote today and take the next step in securing your family’s financial stability.

Factors Affecting the Insurance Rates in Michigan

It is crucially important to understand what impacts your insurance rate, especially when you are looking for cheap insurance in Michigan. Whether you need affordable auto insurance, motorcycle insurance, or renter’s insurance, to secure the best coverage at a cheap rate you must consider knowing the factors that affect insurance rates.

For instance, insurance premiums or rates can vary significantly based on location. Besides, your marital status, credit score, and profession may also affect insurance rates. Don’t want high premiums to stand in the way of protecting yourself and your car or other assets? Let’s find out the factors affecting insurance policy prices in detail.

- If you’re a driver looking for affordable car insurance, maintaining a clean driving record may result in lower premiums.

- Younger drivers are considered high-risk drivers, so they may have to pay higher premiums.

- Where you live in Michigan also impacts insurance rates. For instance, urban areas often have higher premiums due to a higher percentage of accidents.

- Location also matters in the case of renter’s insurance rates as some parts of the state can be susceptible to property crime or natural disasters.

- Auto insurance cost may vary depending on the vehicle type including make, model, and age of your vehicle.

- If you have a history of filing an insurance claim, it may lead to a higher insurance rate.

- Factors like age and marital status can also influence the rate of insurance premiums.

Insure with L.A. Insurance today and get secured for both life and assets! Talk to our friendly agent and get your insurance quote online from the comfort of your home.

Tips for Finding Affordable Insurance in Michigan

Do you want to get insured for cars, bikes, commercial vehicles, watercraft, or rental properties? We can help find the cheapest insurance policies based on your needs and budget.

Here are some tips to help you save:

- Compare insurance quotes from different reliable insurers.

- To lower premiums, go for higher deductibles.

- Get multiple policies with the same insurance provider.

- You can inquire about available discounts, such as safe driver or multi-policy discounts.

- If you want lower premiums on the car insurance policy, choose an inexpensive car.

- Review coverage each year to ensure you’re getting the best insurance deal.

Why Is L.A. Insurance the Right Option for You?

Looking for insurance policies that give you supreme priority at an affordable price? Choose L.A. Insurance for your insurance needs in Michigan. We don’t just offer the cheapest insurance policies for Michigan residents but also provide mental peace. At L.A. Insurance, you receive personalized services, competitive rates, and full coverage options. This is why you won’t get in trouble anymore. You can have faith in us without a doubt to protect your valuable life and assets.

Here's what made us the top Insurance company in Michigan:

- Personalized Service

- Competitive Rates

- Full Coverage Options

- Trustworthy and Reliable Protection

- 24/7 Exceptional Customer Service

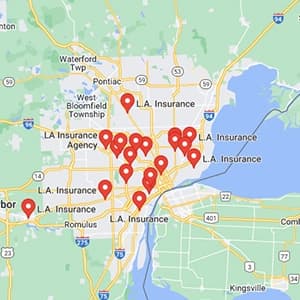

LA Insurance All Locations In Michigan

Explore all our convenient LA Insurance locations across Michigan. With multiple offices statewide, we’re always nearby to provide you with affordable and comprehensive insurance solutions tailored to your needs.

Insurance Services We Offer in Michigan

Find the wide range of insurance services we offer in Michigan. From auto and motorcycle to renters and commercial auto insurance, LA Insurance has all your coverage needs covered.