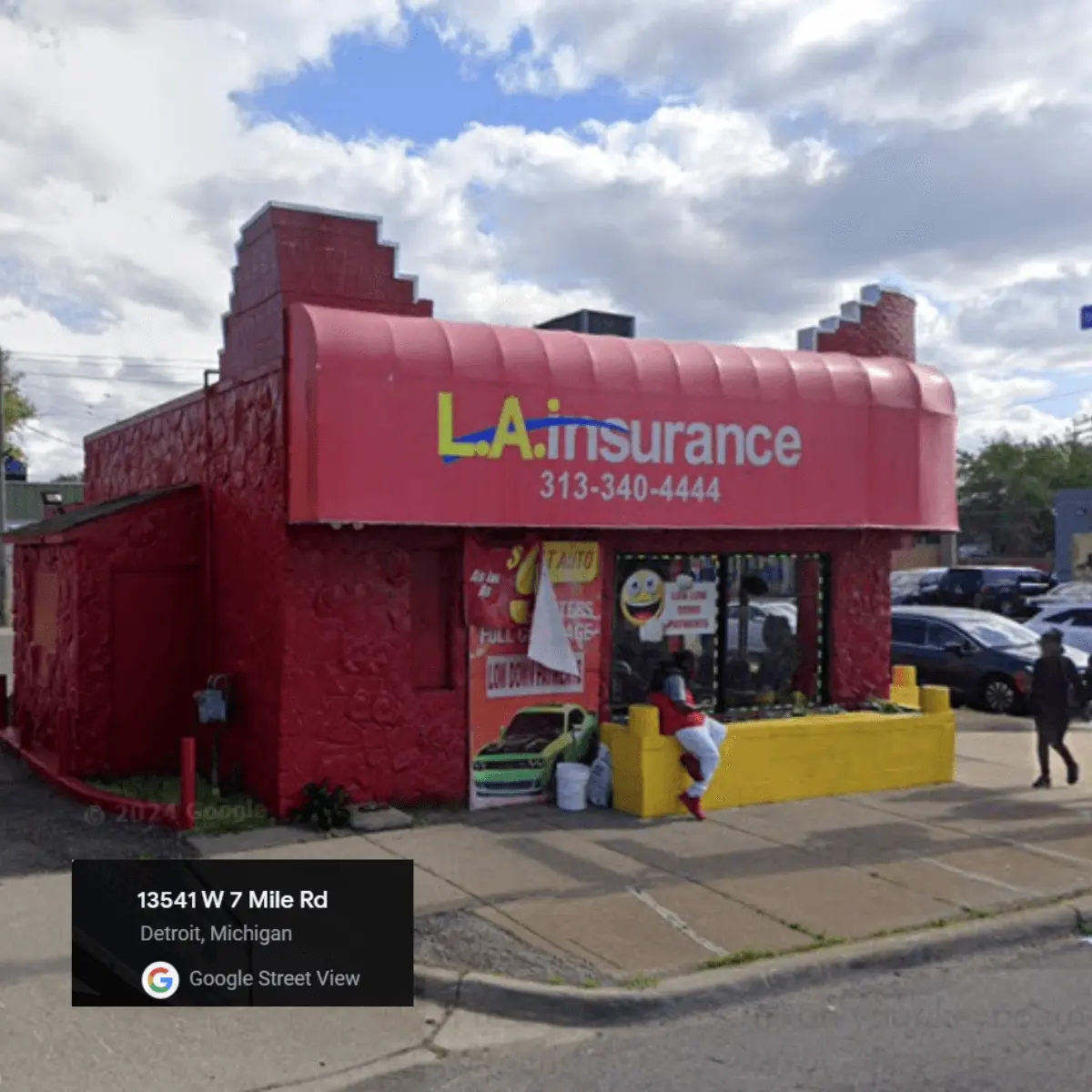

L.A. Insurance Agency MI-43

Cheap Insurance Agency in Detroit, MI

Are you looking for affordable insurance services in Detroit, Michigan? For the last 32 years we have been providing the best insurance policies and coverage that’s affordable for every budget.

In the year 1992, we started our journey in Detroit Michigan with one common vision in mind, and that is to ensure wide range accessibility of affordable insurance throughout the country. Fast forward, it’s been 32 years since, and we have over 200 offices all over the USA with a track record of serving over 10 million satisfied customers.

We have a wide range of insurance policies to keep you financially protected. If you need motor vehicle insurance, we provide insurance services that include Car Insurance, Motorcycle Insurance, RV and Motorhome Insurance, Boat and Watercraft Insurance.

For home insurance solutions, we offer the Renter’s Insurance, and for businesses we provide a specialized Commercial Auto Insurance. At L.A. Insurance, we strive to offer the most affordable insurance policies based on your requirements and budget.

If you are interested in any of our insurance policies in Detroit, Michigan, please request a quote, or visit our office located at 13533 W Seven Mile Rd, Detroit, MI 48235, USA.

Whether you contact us online, or visit our office in-person, our dedicated insurance agents will answer your questions and provide you with a detailed guideline to choose a personalized insurance plan that fits your needs, and budget.

Insurance Policies that We Offer in Detroit, MI

We aim to provide a variety of insurance services in Detroit, Michigan to ensure that we can fulfill your requirements by offering a combination of personalized insurance plans within your budget. Our insurance services include:

Auto Insurance

We offer car insurance services for every automobile out there. Whether it’s a sedan, SUV, electric vehicle, minivan or a sport car, you can find auto insurance solutions for every car at L.A. Insurance at attractive rates within your affordability. Our auto insurance policies include vehicle repair/replacement costs, liability coverage, collision coverage, comprehensive coverage, medical payments and more.

Motorcycle Insurance

Motorcycles are more prone to road accidents than any other vehicle. Our motorcycle insurance policy provides the necessary financial protection to ensure your bike stays financially protected against accidents, theft, and other unforeseen events. The best part is it comes in flexible rates for every budget.

Boat and Watercraft Insurance

The boat and watercraft insurance policy is specifically designed to cover any accidents during your marine voyages. We provide all sorts of financial protections in this policy which covers medical payments, liability, collision, theft, along with natural disasters like tsunami, windstorm and lightning.

RV and Motorhome

We understand how valuable RVs and Motorhomes are. Our RV and Motorhome insurance policies are designed at affordable rates that offer versatile financial protection covering vehicle and property damage, liability, medical expenses, along with collision and comprehensive insurance coverage, among others.

Renter’s Insurance

While you are renting a property, as a tenant it is crucial to ensure that you have proper financial backing to pay your landlord for any property damage expense. Our renter’s insurance provides financial protection at affordable rates to cover property damage liabilities, personal injury protection, medical coverage, and more.

Commercial Auto Insurance

Whether you own a small business, or a large enterprise, with commercial auto insurance you can financially secure your company’s vehicles, and all its employees. Our commercial auto insurance policies provide every bit of financial protection a business need. This includes full insurance coverage such as liability, personal injury protection, medical insurance, collision, comprehensive coverage and more. We cover all company owned vehicles starting from passenger cars to fleets of trucks.

Factors Affecting Insurance Rates in Michigan

Insurance rates are typically determined based on multiple factors. There is no fixed insurance rate, it will vary from one to another. So, whether you’re interested in purchasing auto insurance, motorcycle insurance, renter’s insurance or a combination of different insurance policies, your insurance rate will vary based on the following factors.

- Age: In Michigan, young drivers from the age of 16 to 20 are prone to causing more accidents, so that’s why the youngest drivers tend to pay the highest coverage, but that can vary too based on individual examination.

- Driving Record: If you have a clean driving record, you will be eligible for the cheapest rates, but with a poor driving record it can significantly increase.

- Insurance Claims History: The more insurance that you have claimed the higher your insurance rate is likely to be, as you are deemed a higher risk for the insurance company. But for first timers the accidental forgiveness policy may apply which wouldn’t increase the insurance rate.

- Location: The insurance rate can widely vary depending on which city you’re located in. Usually, larger cities with a high population density have a higher insurance rate as there are more drivers which leads to more accidents. The scope of natural disasters, and crime rates also affect the insurance rates in different cities.

- Vehicle Type, Make and Model: Some vehicles are more prone to accidents. There are vehicles that have a higher maintenance cost. So, when it comes to car or bike insurance the rate ultimately depends on the vehicle. For example, sedans and minivans are cheaper to insure compared to sports cars and luxury vehicles.

- Driver’s License: You must have an active driving license to get auto insurance, if you don’t, then you will have to file for SR-22. With the SR-22 certificate you can get insurance coverage but that will cost you more than regular insurance.

Why is L.A. Insurance the Best Choice for You in Detroit MI?

With a track record of 10 million satisfied customers, and 32 years of committed service, we’ve built a reputation for offering the cheapest insurance services with the best insurance policies and coverage.

Apart from our low rates, here are a few more reasons to consider L.A. Insurance in Detroit, MI.

- Personalized Service

- Competitive Rates

- Hassle Free Insurance Claims Process

- 24/7 Customer Service

- Trustworthy and Reliable Protection

L.A. Insurance Agency MI-43

13545 West Seven Mile Rd., Detroit, MI 48235

Office Hours

Sunday:Closed - Closed

Monday:9:00 AM - 6:00 PM

Tuesday:9:00 AM - 6:00 PM

Wednesday:9:00 AM - 6:00 PM

Thursday:9:00 AM - 6:00 PM

Friday:9:00 AM - 6:00 PM

Saturday:10:00 AM - 1:00 PM

Insurance Services We Offer in Detroit, MI

Find the wide range of insurance options we offer in Detroit. From auto and motorcycle to renters and commercial auto insurance, LA Insurance has all your coverage needs.